Data Scientist Prospect in the Insurance Industry

How Data Scientist enhance their career in the insurance business

How Data Scientist can enhance their career in the insurance business

When I asked, “Where do you want to work?” I hardly find any people who want to work in the Insurance industry, let alone learning Data Science. I could even ask any of my readers right now a question. Please read the question below.

“When you learn about data science, in which industry you want to work as a Data Scientist?”

I am pretty sure Insurance would not become the first choice or even the second choice, and this is not a strange thing.

I am a Data Scientist who works in the Insurance Industry, and in my younger days, I never even expected to work in one. I always dream of working as a biologist or expected to spend my time in academia, but things did not turn out like what I imagine.

However, working in the Insurance industry made me feel more fulfilled than my previous experience. A new experience proved to be a much better pathway for me right now.

This article wants to share the insurance industry prospect for Data Scientist and what it probably would hold in 2021.

Insurance Industry in General

I would guess everybody already knows what Insurance is. Insurance is different from the other kind of product where you get the product the moment you paid it; instead, you only get some promise (usually monetary) if something happened. This is the main premise of the Insurance Industry products, giving you protection if a certain event occurred.

There are many insurance products out there: Life Insurance, Health Insurance, Property Insurance, Pet Insurance, Vehicle Insurance, etc. Just name it, you might able to found it.

While there are many kinds of insurance, not everyone would need all of the available insurance. It would depend on the country they are living in, financial condition, marital status, etc. The appetite for each person is different, after all. Although, one thing for sure; Everyone would need Insurance at some points in their life.

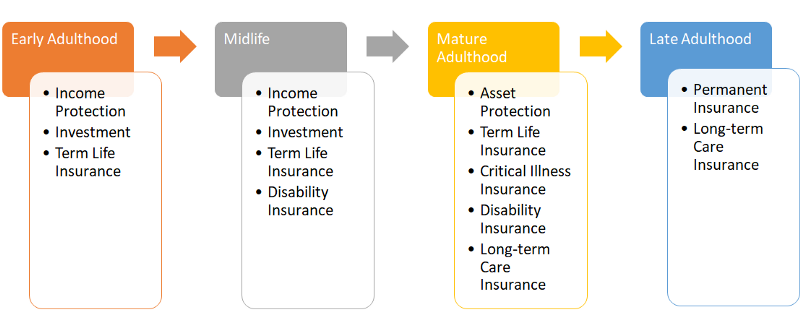

The image above is an example of what kind of insurances we need in each stage of life. From income protection to the Long-term Care Insurance, there would be a time we would need and Insurance.

Insurance Industry for Data Professional

Insurance Data Scientist

I am not here to selling insurances but to explain the insurance prospect as a Data Professional. At a glance, the Insurance Industry might not have the same hypes as the healthcare or technology field, but I want to show you otherwise.

From the general explanation about Insurance, I have explained that Insurance covers every single life stage. In each stage, the necessity is different as well.

In the past, the Insurance company would adjust its product for each stage according to the higher-up decision or what the company feel like. But, the coming age of the Big Data era changes everything. Insurance is not just an old school industry basing the instinct; data help that decision.

Let’s take a look at how the process has changed over time. The easiest example is the insurance underwriting process (Insurance company assessing potential customer to take the financial risk for a fee). Traditionally, the underwriting process requires customer assessment based on certain data; e.g. gender, age, occupation, etc. As time progressed, we realize that assessing customers is limited to the demographic, but it could be anything. We might assess them from:

Health Wearable devices data

Social media data

Electoral rolls data

Credit reports data

Website analytics data

Government statistics data

Satellite data

and many more. The point is that the way we see a problem in insurance would not limit one thing, but it relies on many aspects. Insurance Data Scientist needs to know many aspects; Finance, Technology, Government, Healthcare, etc. I do not say we need to be the expert in all these fields, but the great Data Scientist would certainly knowledgeable in all of these fields.

Why the Insurance Industry?

It seems intimidating, but the rewards are high as well. The data-driven decision and AI implementation are still considered a new thing in the Insurance industry, but it is slowly progressing toward the data culture.

For many data aspirant, Insurance Industry could be one of your entry points to the Data Science world. I believe the talent scarcity within this industry is high enough (Even I would try to look for fresh data scientist if there are no hiring freeze).

Moreover, with a recent entry for the Insurance Industry, you could fuel your creativity on the data project as long as it benefits the company. Of course, the work could be harder if the management did not understand the benefit of the data; but then again, I think it happens in every company.

If you are not sure what kind of data projects within the Insurance Industry, I would give you a few examples:

Risk Assessment

Fraud Detection

Claim Automation

Customer 360

The use cases are not limited to, I stated above. You could try to think about any crazier project you could do. The limit is the sky, after all.

The people trend to bought insurance now, especially the health and life insurance in the Covid-19 pandemic. Believe me when I said that the Insurance sales number had increased exponentially during this pandemic situation. I might not show the data because of confidentiality, but I am sure people already realize how precious health is.

I have tried to assess the situation with the data, and for a longer time, the Insurance Industry would thriving more. With more demand would come to a need for more talent to evaluate the situation. If you already experienced within this industry, you could move along easily within the data field.

Conclusion

Insurance Industry might not an industry you think initially when you become a Data Scientist. Still, it could be a choice for some people because this is a relatively new industry introduced to the data culture. Why Insurance Industry:

Could become an Entry Point for aspiring Data Scientist

Showing your creativity because it is a fresh field in the data

Insurance Industry amidst pandemic is growing exponentially

Experience within the Insurance Industry data field is viable in another Industry in case you want to move.